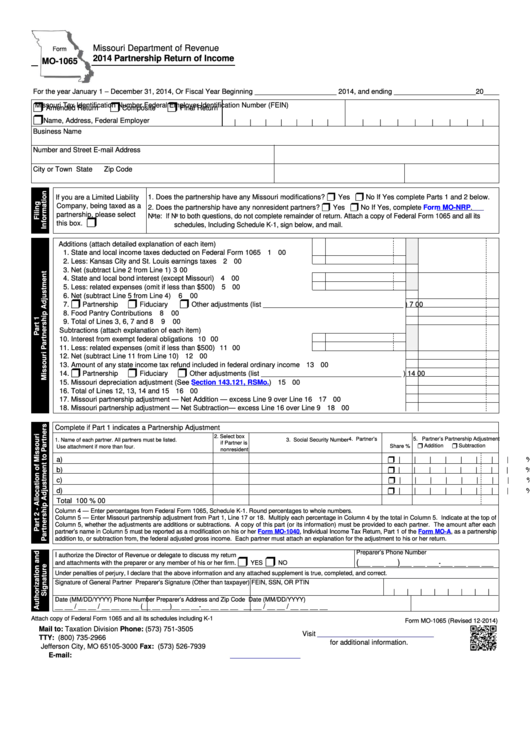

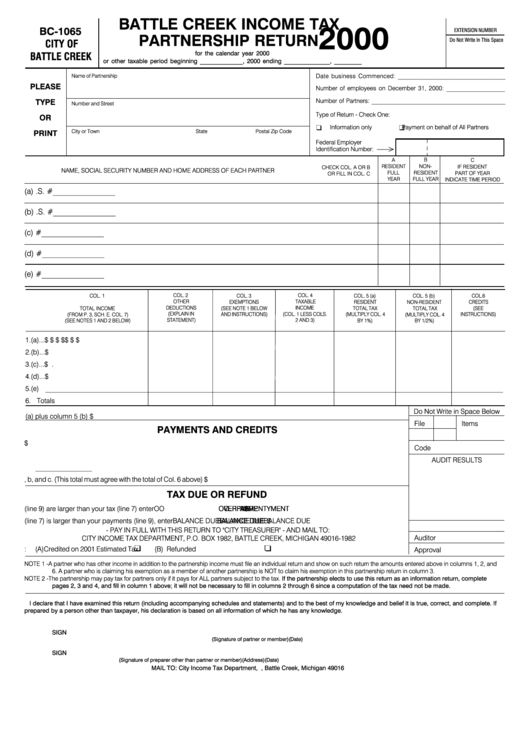

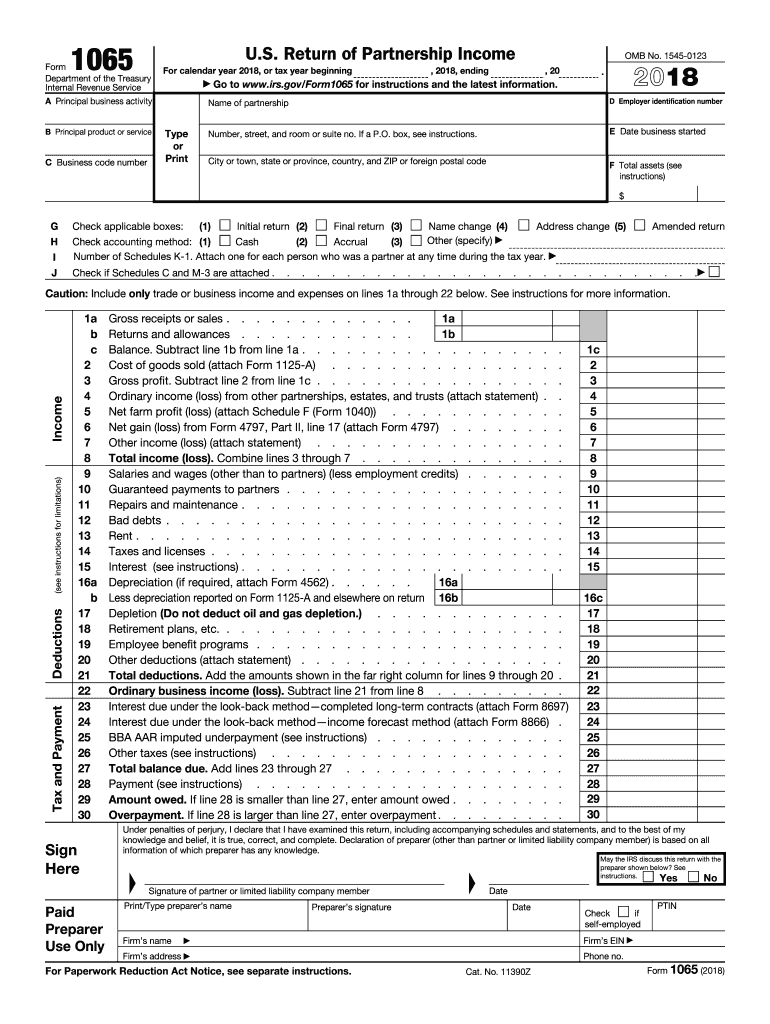

The Form 1065 instructions can be a bit confusing, as partners are required to pass on the information on Form 1065 to his or her own return using Schedule K-1 Forms. How to File Form 1065Īside from a few exceptions, all domestic partnerships are required to file a Partnership Tax Return.

Additionally, Limited Liability Companies (LLCs) that are classified as partnerships for federal tax purposes are also required to file a Partnership Tax Return using Form 1065. Note that the term “partnership” may also include a syndicate, group, pool, joint venture, or any unincorporated organization through which business is carried on (that is not, under regulations imposed section 701, considered a corporation, trust, estate, or sole proprietorship). There are several different types of partnerships, including: As opposed to a sole proprietorship, each member of a partnership contributes money, property, labor, and/or skill with the expectation to share in the profits and losses. Not sure if your small business constitutes a partnership and uncertain as to whether or not you need to file tax Form 1065? The IRS defines a partnership as relationship between two or more people who join to carry on a trade or business. Although a partnership does not pay taxes on its income, it does “pass through” any profits or losses to its partners, meaning individual partners must include their partnership items on their personal tax or information returns using Form 1040 or its equivalent. It’s used to report a partnership’s income, gains, losses, deductions, credits, and pertinent financial information.

What is Form 1065?įorm 1065 is otherwise known as a “Partnership Tax Return” or “Return of Partnership Income”. Have you recently formed a partnership and heard the term “Form 1065” tossed around? Not sure about Form 1065 instructions, or who’s required to file? Failing to follow the protocol for IRS Form 1065 could land you in some hot water with the government, so keep reading to learn the ins and outs of this critical document to safeguard your new business’s success.

0 kommentar(er)

0 kommentar(er)